Seeking alpha in US senators’ stock transactions

To analyze the relationship between information asymmetry and the returns generated when U.S. senators use political information to trade stocks, this review examines the study titled “A Dilemma of Self-interest vs Ethical Responsibilities in Political Insider Trading” by Jan Hanousek et al., published in the Journal of Business Ethics in October 2022. The study empirically investigates whether senators’ stock trades contradict social contract theory and explores the informational value of their transactions.

Methodology

This study is based on a dataset of 8,064 securities transactions, including 7,092 stock trades disclosed by U.S. senators under the STOCK Act between 2012 and 2019. To measure the information asymmetry associated with senators’ transactions, the study employs Abnormal Idiosyncratic Volatility (AIV), a metric that captures changes in stock volatility during specific events and is particularly suited for evaluating the likelihood of trades based on insider information.

Key Points of Methodology

-

Abnormal Idiosyncratic Volatility (AIV): This measures the level of information asymmetry by analyzing volatility changes around trading days compared to normal periods.

-

Event Window: A 5-day event window (2 days before and after the trade day, including the trade day) was used to calculate abnormal volatility and compare it with other periods.

-

Focus: The study sought to determine whether senators’ trades generated higher AIV than major corporate events like quarterly earnings announcements or mergers and acquisitions (M&A), linking political insider information to stock returns.

AIV Calculation

-

Transaction Volatility (IVATT): Daily volatility during the 5-day event window was measured, excluding market-wide factors.

-

Non-Transaction Volatility (IVNAT): Volatility during other periods of the year was calculated similarly.

-

AIV: The difference between IVATT and IVNAT. A higher AIV indicates a greater likelihood that specific information influenced the stock on the transaction day.

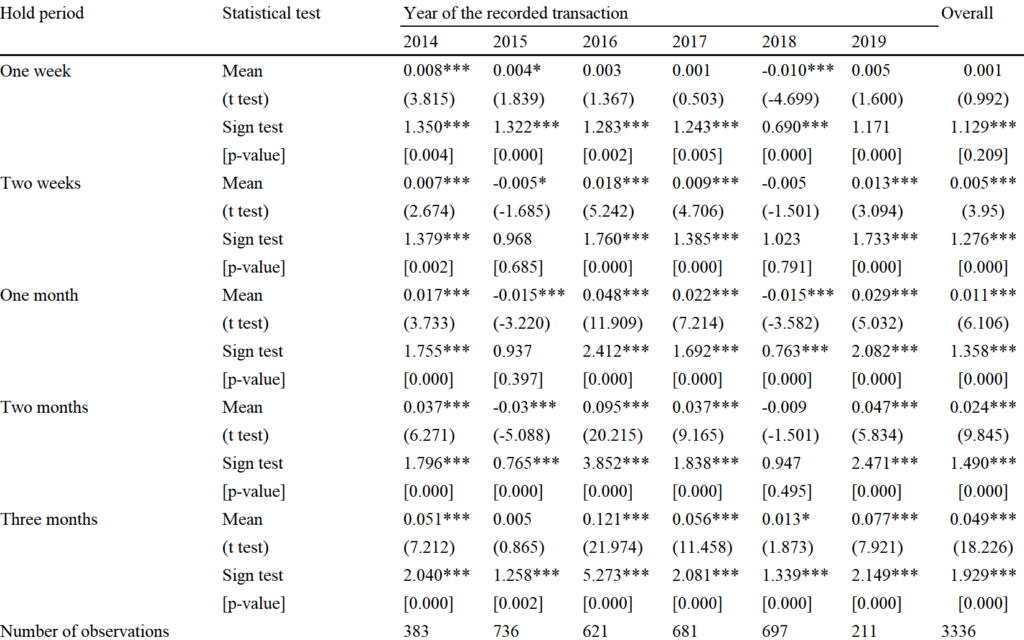

The study confirmed that senators’ stock trades are associated with significant abnormal returns. Specifically:

-

Stocks traded by senators recorded an average excess return of 4.9% over three months after the transaction date.

-

As shown in the data, senators’ trades consistently outperformed the market over holding periods of 1 week, 2 weeks, 1 month, 2 months, and 3 months.

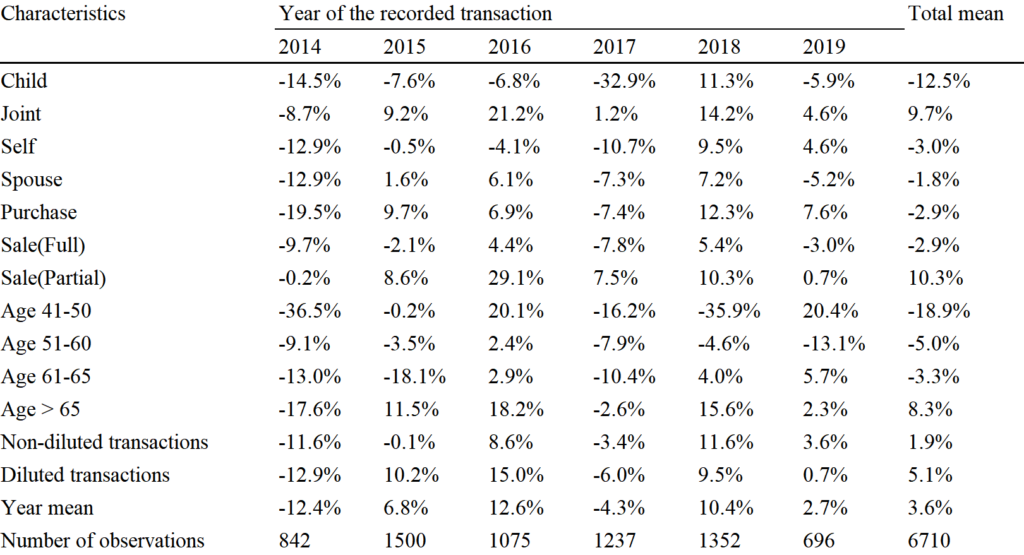

In terms of information asymmetry, senators’ trades recorded an average Abnormal Idiosyncratic Volatility (AIV) of 3.6%, which is three times higher than the 1.1% AIV observed during major corporate earnings announcements. This indicates that senators’ stock transactions are accompanied by significant information asymmetry.

Such asymmetry suggests that the political information held by senators carries substantial value in the stock market and demonstrates that senators participate in market transactions from a privileged position of informational advantage over other investors.

Conclusion

This study confirms that senators’ stock trades induce information asymmetry and exhibit a strong correlation with stock price volatility. Specifically, the timing of their transactions aligns with heightened AIV, indicating that the information senators use is indeed reflected in stock prices.

The existence of information asymmetry between U.S. politicians and the general public, coupled with the fact that senators achieve market-beating returns by holding stocks for three months after their purchases, suggests that trading based on senators’ political information could hold value as an investment strategy.